Compound rate of return

The compound annual growth rate CAGR also called the annualized rate of return differs from the simple rate of return in that it considers the compounding effect of. No minimums no fees no worries.

How To Calculate Yield To Maturity In Excel In 2022 Excel Templates Excel Maturity

Open your account today.

. So the annualized total return of the mutual fund is 923. You could be earning more interest. Investors can currently expect inflation to reduce purchasing power by 2.

No minimums no fees no worries. Ad These Online Savings Accounts Offer Up To 21X Higher Interest Than A Traditional Bank. Balances Best-In-Class Interest Rates Usability Lead Our Top Recommendations.

This result is way too high. Suppose you then wanted to compare the return of this mutual fund with another and it gives different annual. The compound annual growth rate CAGR is the rate of return RoR that would be required for an investment to grow from its beginning balance to its ending balance.

You could be earning more interest. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Check out the chart below.

Lets us assume the following. Ad The numbers dont lie. The rate of return shows the amount of time it will take to recover ones investment.

Compound returns are a more accurate measure as compared to average returns to calculate. Compare Open an Account Online Today. 92052 1 - -7948 84736.

The compound growth rate is a measure used specifically in business and investing contexts that indicates the growth rate over multiple time periods. 10000 invested today with no additional contributions that grows at 9 per year which is roughly the historical average return of the. Compound return is the rate of return for capital over a cumulative series of time.

And its not just a 70 5 x 14 return but a 100 return on your. In this case the data is being shown from the beginning of the year as in the entire yearly return in 2015 10 the entirely yearly return in 2016 15. Thus the interest of the second year would come out to.

Ad Grow Your Savings with the Most Competitive Rate. If you average just a tad more than a 14 return for each year for 5 years you will have doubled your money. 1000 1 - -7948 92052.

From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 113 source. Length of time in years that. Ad The numbers dont lie.

Rate of return Current value Initial value Initial value 1 0 0 textRate of return fractextCurrent value - textInitial valuetextInitial valuetimes 100. View the Savings Accounts That Have the Highest Interest Rates in 2022. Finally subtract 1 from Y and then multiply the resulting figure by 100 to obtain the rate of return in percentage format.

The most common way to calculate investment returns is to use a time-weighted average. This method is perfect for traders who start with one pool of money and dont add to. You finished with 780 or a compound annual growth rate of -7948 a year.

Rates of return Lifecycle funds. To calculate the correct annualized rate of return. Because due to compounding 5 years of 20 returns would result in an ending value of.

For example if one invests 1000 and receives 150 in the first year of the investment the rate of return is. It is a measure of. 1000 x 120 5 248832.

110 10 1. 84736 1 - -7948 78001. The average stock market return is historically 10 annually though that rate is reduced by inflation.

How to calculate return rate. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Open your account today.

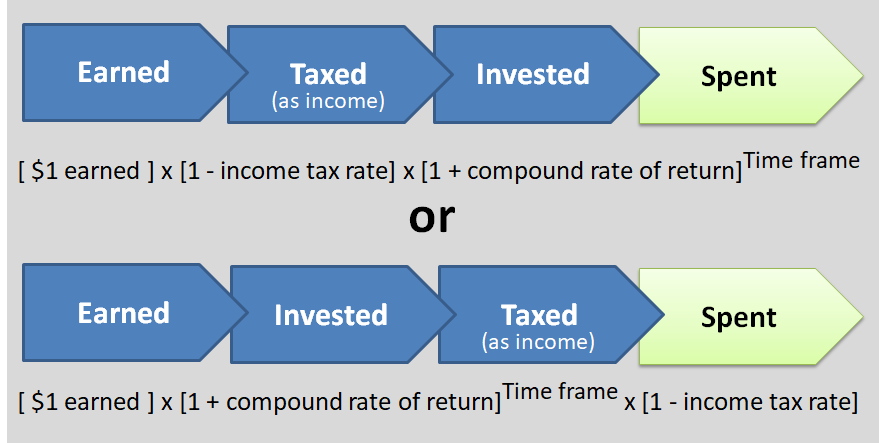

Illustrating The Value Of Retirement Accounts Retirement Accounts Accounting Investing

Compound Interest Ci Formulas Calculator Compound Interest Interest Calculator Formula

Simple And Compound Interest Meaning Formula And Example Compound Interest Investment Compound Interest Accounting Education

3 Ways To Make The Best Use Of Power Of Compounding Are To Start Early Investing Wisely And By Investing Regularly Financial Goals Money Lessons Invest Wisely

Got Millionaire Envy This Chart Can Help Marketwatch Become A Millionaire How To Become Clark Howard

Compounding Interest Rate Chart Interest Rate Chart Financial Charts Chart

Cagr Compounded Annual Growth Rate Explained In This Post With An Examples Which Differentiates It From Understanding The Stock Market Investing Stock Market

How To Calculate Future Value With Inflation In Excel Exceldemy Excel Formula How To Introduce Yourself Excel

Compounding Growth Visualization Roth Ira Investing Early Retirement

Simple Interest Compound Interest Continuously Compounded Interest Simple Interest Math Simple Interest Word Problems

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

Rate Of Compound Interest 8th Wonder Of The World Gre Gmat Sat Cat High School Math High School Math Gmat Wonders Of The World

Use The Rule Of 72 To Understand Compound Interest Finance Investing Personal Finance Organization Investing Money

The Benefits Of Starting Early Compoundinterest Financial Education Investing Education

Simple Interest Compound Interest Continuously Compounded Interest Studying Math Math Methods Simple Interest Math

Simple Vs Compound Interest Visual Ly Finance Infographic Compound Interest Financial Literacy